Red Lobster TGI Fridays Closing: Why Iconic Chains Are Fading

The phrase "**Red Lobster TGI Fridays closing**" has sent ripples of concern through the American casual dining scene. Once beloved for their comfort food, vibrant atmospheres, and as go-to spots for celebrations and family meals, these two iconic American chain restaurants are now facing significant challenges, signaling a major shift in the casual dining industry. For many, the news isn't just about business; it's about the potential loss of places that hold cherished memories.

These establishments, which used to be super popular destinations for birthday dinners, date nights, and family gatherings, are struggling to adapt to rapidly changing consumer preferences and an increasingly competitive landscape. This article aims to explain the reasons behind these closures, detail how many stores are affected, and shed light on what each company is doing now, as well as the broader implications for the restaurant industry.

Table of Contents

- The Unfolding Saga: Red Lobster TGI Fridays Closing Their Doors

- A Closer Look at the Numbers: How Many Stores Are Affected?

- The Deep Dive: Why Red Lobster Faced Bankruptcy

- TGI Fridays' Tribulations: Navigating Changing Tastes

- Beyond the Big Two: A Wider Industry Shift

- The Future of Former Locations: What Happens Next?

- Adapting or Fading: Lessons from the Closures

- Conclusion: The Evolving Plate of American Dining

The Unfolding Saga: Red Lobster TGI Fridays Closing Their Doors

Recently, the restaurant industry has witnessed significant upheaval, with prominent chains like Red Lobster and TGI Fridays announcing closures across multiple locations nationwide. The phrase "**Red Lobster TGI Fridays closing**" has sparked concern among restaurant lovers across the United States, with rumors swirling and news headlines suggesting the worst. Many diners are wondering whether these two American dining staples are shutting their doors forever, or if this represents a strategic, albeit painful, restructuring.

Once beloved staples for casual dining, both establishments have announced their closures, leaving fans reminiscing about family dinners and celebratory nights out. The news, often accompanied by images of darkened restaurants and "For Lease" signs, paints a stark picture of a challenging market. While the immediate impact is felt by communities losing a familiar dining spot, the underlying reasons for these closures are complex, involving a mix of internal mismanagement, shifting consumer habits, and broader economic pressures. The struggles of these chains are not isolated incidents but rather symptomatic of a larger transformation occurring within the casual dining sector, forcing long-standing brands to either adapt or face obsolescence.

A Closer Look at the Numbers: How Many Stores Are Affected?

The scale of the closures associated with the **Red Lobster TGI Fridays closing** trend is substantial and highlights the severity of the challenges faced by these long-standing brands. Chains like Red Lobster and TGI Fridays filed for bankruptcy this year and closed more than 175 restaurants combined. This figure represents a significant portion of their operational footprint and underscores the financial distress that has led to these drastic measures.

Specifically, TGI Fridays recently closed 50 restaurants and filed for Chapter 11 bankruptcy after foot traffic was reported to be down more than 35% from the previous year, according to Placer.ai data. This sharp decline in customer visits is a critical indicator of the brand's struggle to attract diners in a post-pandemic world. Red Lobster, known for its seafood offerings, also faced challenges that led to the shuttering of several outlets, with the exact number fluctuating as the bankruptcy proceedings unfold.

It's important to note that this trend extends beyond just these two giants. Denny’s, another well-known casual dining chain, is also closing 150 restaurants, further illustrating the widespread difficulties within the sector. The impact of these closures is far-reaching. Each closing location means job losses for servers, cooks, hosts, and managers—individuals who rely on these establishments for their livelihoods. The ripple effect extends to local suppliers, landlords, and the overall economic health of the communities where these restaurants once thrived. The closure of these establishments is not merely a business issue; it’s a personal one, affecting thousands of employees and disrupting the fabric of local economies.

The Deep Dive: Why Red Lobster Faced Bankruptcy

The story behind Red Lobster's descent into bankruptcy is a complex narrative of strategic missteps and external pressures, ultimately culminating in the widespread **Red Lobster TGI Fridays closing** phenomenon. At its core, Red Lobster was driven into bankruptcy by mismanagement under a previous owner, global shrimp supplier Thai Union. This relationship, intended to secure a steady supply of seafood, instead created a unique set of challenges that proved insurmountable.

One of the most frequently cited examples of this mismanagement is the ill-fated "Ultimate Endless Shrimp" promotion. While seemingly a customer favorite, turning this limited-time offer into a permanent, all-you-can-eat fixture proved to be a financial disaster. The promotion, priced at an unsustainably low point, led to massive losses as customers consumed more shrimp than the company could profitably provide. This decision, reportedly pushed by Thai Union to increase shrimp sales, severely eroded Red Lobster's profit margins. The chain found itself in a paradoxical situation: popular with diners, but losing money with every plate served.

Beyond the shrimp debacle, Red Lobster also grappled with rising operational costs, including labor and food prices, which squeezed margins further. The restaurant's aging infrastructure and often outdated decor also struggled to compete with newer, more modern dining concepts. Consumer tastes shifted towards healthier options, unique culinary experiences, and greater convenience, leaving Red Lobster's traditional, sit-down model struggling to keep pace. The lack of significant innovation in its menu or dining experience, coupled with the financial strain from the endless shrimp promotion, made it increasingly difficult for the chain to attract and retain a loyal customer base. The bankruptcy filing was not a sudden event but the culmination of years of financial strain and strategic misdirection, illustrating a cautionary tale for the entire casual dining industry.

TGI Fridays' Tribulations: Navigating Changing Tastes

While Red Lobster's struggles were heavily tied to specific operational missteps, TGI Fridays' challenges, contributing to the broader **Red Lobster TGI Fridays closing** trend, appear to stem more from a fundamental shift in consumer dining preferences and the competitive pressures of the modern restaurant landscape. TGI Fridays fell under private equity owner TriArtisan Capital Advisors, a common scenario where financial restructuring often comes with aggressive cost-cutting and a focus on short-term profitability, sometimes at the expense of long-term brand health and innovation.

The data from Placer.ai paints a clear picture: TGI Fridays experienced a significant decline in foot traffic, down more than 35% from the previous year. This substantial drop indicates that fewer people are choosing TGI Fridays for their casual dining needs. The brand, once synonymous with a lively, celebratory atmosphere and American comfort food, has struggled to remain relevant in an era where diners have a plethora of choices, from fast-casual eateries to specialized culinary experiences.

Changing consumer preferences play a crucial role here. Younger generations, in particular, often prioritize unique, Instagrammable dining experiences, healthier food options, and efficient service. TGI Fridays, with its established model, found it challenging to pivot quickly enough to meet these evolving demands. Its menu, while offering familiar favorites, often didn't stand out against newer, more innovative competitors. Furthermore, the rise of food delivery services and meal kits has also impacted traditional dine-in establishments. Consumers increasingly prefer the convenience of enjoying restaurant-quality food at home, reducing the need for a full sit-down experience. The brand's inability to consistently drive foot traffic, combined with rising operational costs and the pressure from its private equity owners, ultimately led to the difficult decision of closing numerous locations and filing for Chapter 11 bankruptcy.

Beyond the Big Two: A Wider Industry Shift

The narrative of **Red Lobster TGI Fridays closing** is not an isolated incident but rather a prominent symptom of a broader, more profound transformation sweeping across the entire restaurant industry. The challenges faced by these two iconic chains reflect a struggle that many traditional casual dining establishments are experiencing. As mentioned, Denny’s is also closing 150 restaurants, signaling that even long-standing breakfast and diner concepts are not immune to these pressures. The struggles are not limited to the food service sector either; reports indicate that major retailers like Big Lots and Macy's are also facing significant hurdles, suggesting a widespread re-evaluation of brick-and-mortar business models in general.

The restaurant landscape is changing at an unprecedented pace, driven by a confluence of technological advancements, economic shifts, and evolving consumer values. What worked for decades—a large, often themed restaurant offering a diverse menu at a moderate price point—is now being challenged by new dining formats and shifting expectations.

The Rise of Fast-Casual and Delivery

One of the most significant disruptors to traditional casual dining has been the meteoric rise of the fast-casual segment. Concepts like Chipotle, Panera Bread, and Five Guys offer a perceived higher quality of food than traditional fast food, with customizable options and quicker service, often at a similar price point to casual dining without the need for tipping or extended wait times. Consumers, especially younger demographics, are increasingly opting for the convenience and perceived value of fast-casual restaurants.

Concurrently, the explosion of third-party food delivery services (e.g., DoorDash, Uber Eats, Grubhub) has fundamentally altered how people consume restaurant food. Many diners now prefer the convenience of having meals delivered directly to their homes, reducing the incentive to dine out at a full-service restaurant. While many casual dining chains have attempted to integrate delivery into their models, the associated fees, packaging costs, and logistical challenges often eat into already thin profit margins, making it a difficult balancing act. This shift means that the physical dining experience itself needs to offer something truly unique or compelling to draw customers away from their couches.

Economic Headwinds and Operational Challenges

Beyond changing tastes, casual dining chains are also battling significant economic headwinds. Inflation has driven up the cost of ingredients, from seafood to produce, directly impacting food costs. Labor costs have also surged, as restaurants compete for staff in a tight labor market and grapple with rising minimum wages and increased expectations for benefits. These escalating operational expenses put immense pressure on profit margins, forcing chains to either raise prices (potentially alienating price-sensitive customers) or absorb the costs, further straining their finances.

Maintaining large, full-service restaurant operations comes with substantial overheads, including rent for expansive spaces, utility bills, and the cost of maintaining kitchen equipment and dining areas. In an environment where foot traffic is declining, these fixed costs become an even heavier burden. The sheer scale of operations for chains like Red Lobster and TGI Fridays, with hundreds of locations, means that even small inefficiencies or market shifts can have a massive cumulative impact, making them more vulnerable to economic downturns and changes in consumer behavior than smaller, more agile establishments. The combined effect of these internal and external pressures creates a perfect storm, making the continued operation of some locations simply unsustainable.

The Future of Former Locations: What Happens Next?

The closures resulting from the **Red Lobster TGI Fridays closing** trend leave behind a significant amount of commercial real estate, raising questions about the future of these once-bustling locations. As these iconic restaurants shut their doors, their physical spaces don't simply vanish; they represent valuable real estate that will eventually be repurposed. This transformation of former restaurant sites is a common occurrence in the dynamic retail and dining landscape, reflecting ongoing shifts in consumer demand and urban development.

In some cases, these prime locations are quickly snapped up by other restaurant concepts looking to expand or enter new markets. For example, in Woodbridge, Virginia, a LongHorn Steakhouse will take over an old TGI Fridays. This scenario often benefits the new tenant, as the site is already equipped with kitchen infrastructure, dining areas, and ample parking, reducing build-out costs and time. It also signals that while some casual dining models are struggling, others are thriving and actively seeking expansion opportunities.

However, not all former restaurant sites remain in the dining sector. The versatility of these commercial spaces means they can be converted for a variety of uses. In Watertown, New York, a former Red Lobster is being converted to a Northern Credit Union Bank. This illustrates a broader trend where retail spaces are being redeveloped for non-traditional uses, including financial institutions, medical clinics, fitness centers, or even residential developments. The decision to convert a restaurant into a bank, for instance, highlights the changing needs of communities and the adaptability of commercial real estate.

The repurposing of these locations has a dual impact. On one hand, it can revitalize a dormant space, bringing new businesses and potentially new jobs to the area. On the other hand, it signifies the permanent departure of a familiar brand, which can evoke a sense of nostalgia and loss for long-time residents. The transformation of these sites is a tangible reminder of the constant evolution of the commercial landscape, where old gives way to new, driven by market forces and changing consumer demands. The fate of each closed Red Lobster and TGI Fridays location will ultimately depend on its specific market conditions, location, and the vision of its new owners or developers.

Adapting or Fading: Lessons from the Closures

The widespread **Red Lobster TGI Fridays closing** phenomenon serves as a stark warning and a critical learning opportunity for the entire casual dining industry. The struggles of these once-dominant chains underscore the imperative for established brands to continuously adapt, innovate, and remain acutely attuned to evolving consumer preferences. In a market characterized by intense competition and rapid shifts in dining habits, complacency can be a death knell.

One of the primary lessons is the need for constant menu innovation. Diners today seek variety, healthier options, and unique culinary experiences that go beyond traditional comfort food. Chains that fail to refresh their offerings, incorporate global flavors, or cater to dietary restrictions risk becoming stale and irrelevant. Beyond the menu, the dining experience itself must evolve. This includes everything from the restaurant's ambiance and decor to the efficiency of service and the integration of technology.

Innovation and Reinvention

Successful casual dining chains are those that have embraced innovation and reinvention. This can manifest in several ways:

- Digital Transformation: Investing in robust online ordering platforms, mobile apps, and loyalty programs to enhance convenience and personalize the customer experience.

- Menu Evolution: Regularly introducing new, exciting dishes while retaining beloved classics. This might include plant-based options, locally sourced ingredients, or limited-time offers that create buzz.

- Optimized Footprint: Exploring smaller, more efficient restaurant formats that are better suited for urban environments or carry-out/delivery focused operations, reducing overheads.

- Experience-Driven Dining: Creating unique in-restaurant experiences that cannot be replicated at home, such as interactive elements, themed events, or exceptional customer service that fosters loyalty.

- Value Proposition: Redefining what "value" means to today's consumer, which isn't always about the lowest price but often about perceived quality, convenience, and overall experience.

Chains that have managed to navigate these turbulent waters often demonstrate agility in decision-making and a willingness to invest in future-proofing their businesses, rather than clinging to outdated models.

The End of an Era, or a New Beginning?

The closures of Red Lobster and TGI Fridays undoubtedly mark the end of an era for many who grew up with these brands. They represent a significant shift away from the traditional, full-service casual dining model that dominated the American restaurant scene for decades. However, this "end" can also be viewed as a catalyst for a new beginning in the industry.

The market is not shrinking; it is merely reconfiguring. New concepts are emerging, existing chains are adapting, and the focus is shifting towards efficiency, convenience, and highly curated experiences. While the nostalgia for the past is understandable, the future of dining lies in innovation and responsiveness. The lessons learned from the struggles of these giants will likely shape the strategies of other casual dining chains for years to come, pushing them to be more agile, customer-centric, and economically sustainable in an ever-evolving landscape.

Conclusion: The Evolving Plate of American Dining

The news of "**Red Lobster TGI Fridays closing**" is more than just a headline; it's a profound indicator of the seismic shifts occurring within the American casual dining industry. These closures, driven by a combination of internal mismanagement, particularly in Red Lobster's case, and broader changes in consumer preferences and economic conditions, highlight the immense pressure on established restaurant chains. With over 175 combined locations shuttered and thousands of jobs impacted, the human cost of this transformation is undeniable.

The era of relying solely on a familiar brand name and a consistent, albeit unchanging, menu is rapidly fading. Today's diners demand more: convenience, value, unique experiences, and often, healthier or more diverse culinary options. The rise of fast-casual dining and the pervasive influence of food delivery services have fundamentally altered the competitive landscape, forcing traditional sit-down restaurants to either innovate or risk obsolescence. The struggles of Red Lobster and TGI Fridays, alongside other chains like Denny's, serve as a potent reminder that even the most iconic brands are not immune to the forces of market evolution.

As we look ahead, the restaurant industry will continue to adapt. Former restaurant sites will be repurposed, new concepts will emerge, and existing chains will strive to reinvent themselves, focusing on agility, digital integration, and a deep understanding of what today's consumers truly desire. While the nostalgia for the past may linger, the future of American dining promises a landscape that is more dynamic, diverse, and responsive than ever before.

What are your thoughts on the evolving dining landscape? Do you have cherished memories of Red Lobster or TGI Fridays? Share your experiences and predictions for the future of casual dining in the comments below. Your insights help us understand the pulse of this ever-changing industry.

- Mariann Edgar Budde

- Sydney Sweeney Ass

- Caf%C3%A9 China New York Ny

- Gabriela Rico Jimenez

- Sofronio Vasquez

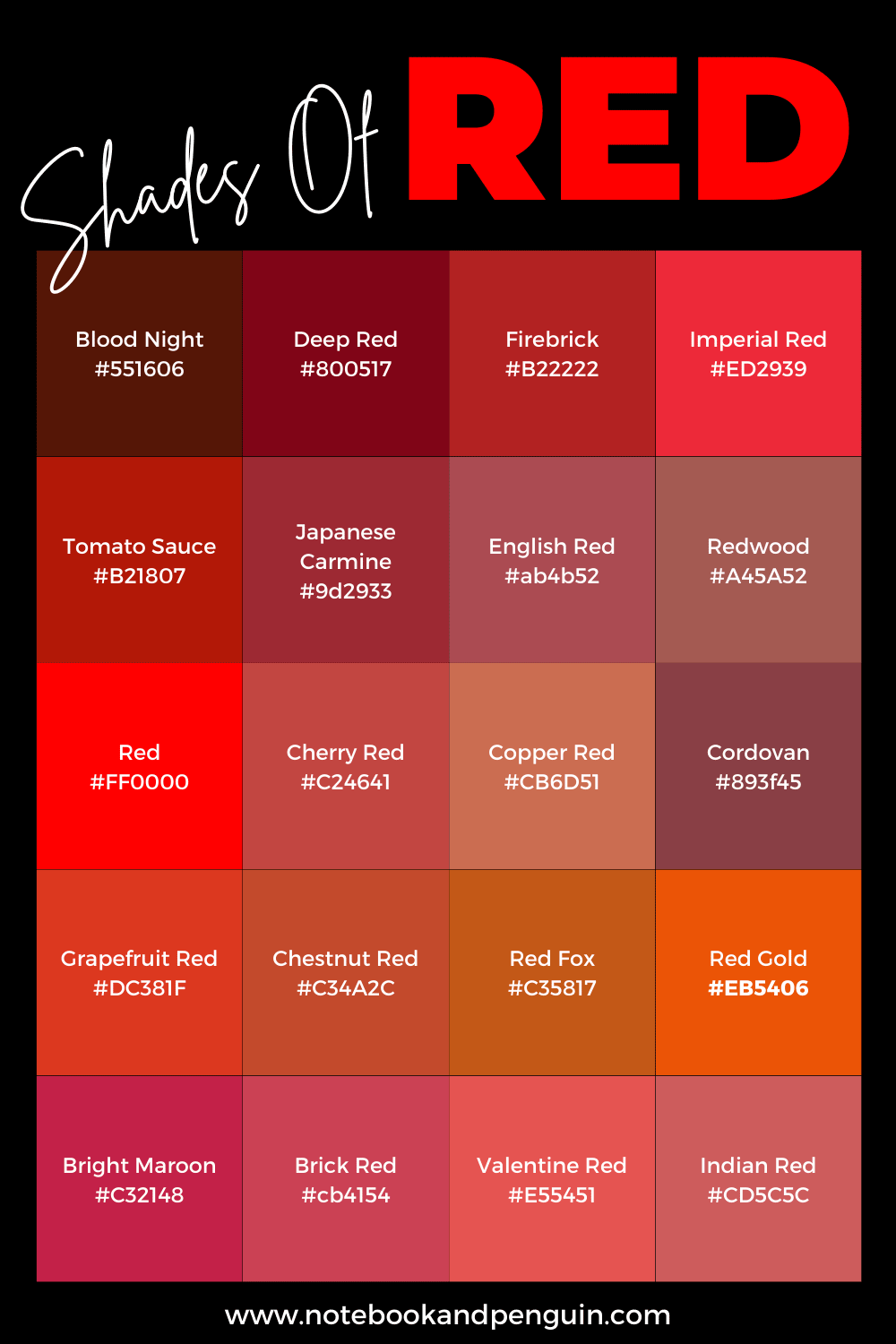

Cardinal Red Color

65+ Red Hex Codes (With Red Color Names & RGB Values)

Crimson Red Color | ArtyClick